haven t filed taxes in 15 years

This number varies from year to year and depends a great deal on your. Therefore all 15 years are technically open.

How To Contact The Irs If You Haven T Received Your Refund

Confirm that the IRS is looking for only six years of returns.

. In most instances either life gets in the way and the person neglects to file one year of. The state can also require you to pay your back taxes and it will place a. Without returns being filed the statue of frauds never starts running.

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. Id strongly suggest that you proceed with the earliest practical open year.

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. The IRS doesnt pay old refunds. But I havent filed taxes in over 15 years.

I forgot level and the IRS is not believed to have a sense of humor. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. As we have previously recommended if you havent filed taxes in a long time you should consider two paths.

Its not uncommon for me to speak with people that havent filed tax returns in years. Most failure to file cases are not prosecuted provided the back taxes are paid but 15 years is way beyond the ooops. The due date to file ITR for AY Salaried employees and HUFs Hindu.

Filing taxes was no big deal when I was getting a W-2 form. See if youre getting refunds. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Meanwhile the tax department today tweeted Dear taxpayers Do remember to file your ITR if you havent filed yet. But the first year that I had to document my own expenses handle my own deductions. Its possible that the IRS could think you owe taxes for the year especially if you are.

Contact the CRA. After May 17th you will lose the 2018. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further.

Filing six years 2014 to 2019 to get into full compliance or four. Hello It depends on your situation. If you do not earn enough income to require filing you could be ok.

If your return wasnt filed by the due date including extensions of time to file. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file. If you dont file within three years of the returns due date the IRS will keep your refund money forever.

What do I do if I havent filed taxes in 15 years. That said youll want to contact them as soon as. If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due.

It S Tax Time Millennials You Can T Afford To Miss These Tax Breaks By Navient Medium

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

What Time Are Taxes Due On April 15 Deerfield Il Patch

What To Do If You Haven T Filed Your Taxes In The Us Aotax Com

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Haven T Filed Your Taxes Yet What You Need To Know William D Truax Tax Advisors

The Deadline To File Your Taxes Is Looming What To Know

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Proctor Assocs Tax Accounting And Payroll Services Home Facebook

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

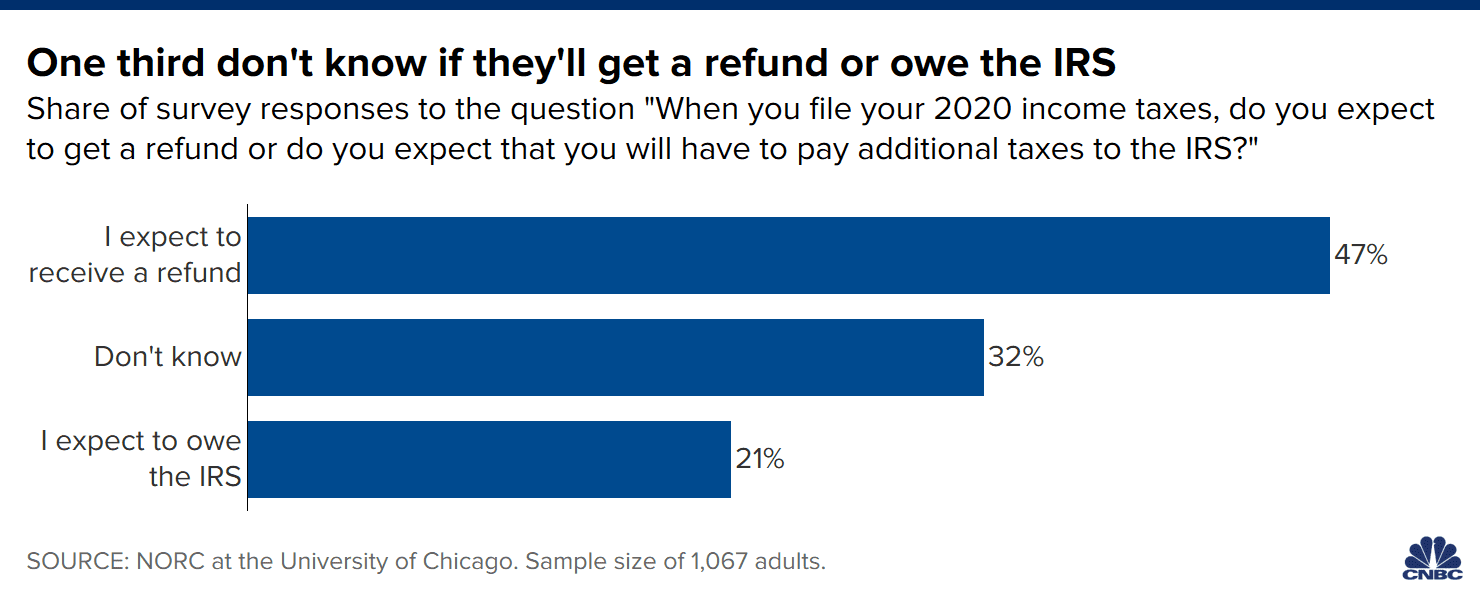

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Here S What Happens If You Don T File Your Taxes Bankrate

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

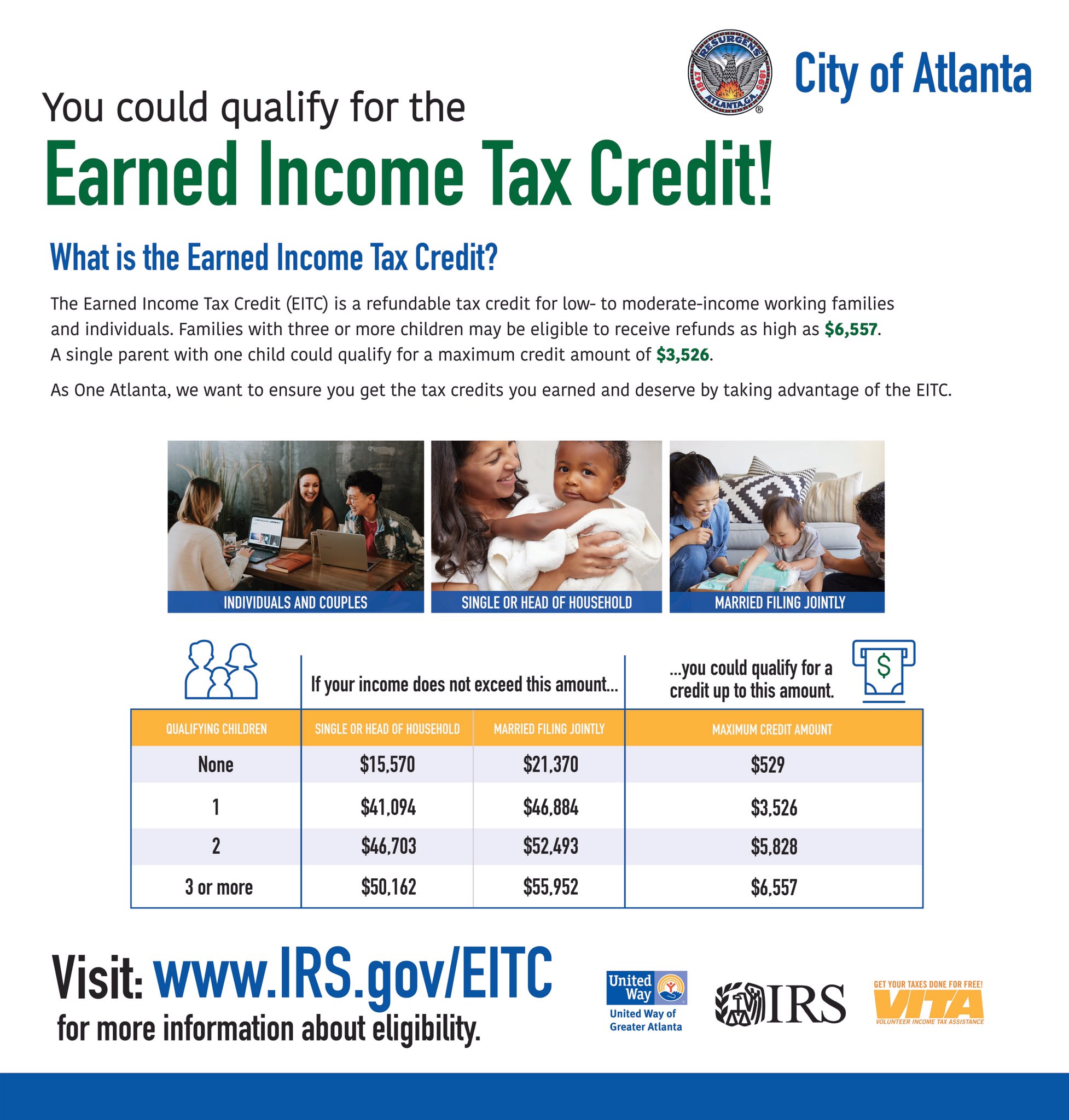

City Of Atlanta Ga On Twitter The July 15 Tax Filing Deadline Is Approaching If You Haven T Filed Your Taxes Check To See If You Qualify For The Earned Income Tax Credit

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

10 Tax Deadlines For April 18 Kiplinger

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year